rsu tax rate ireland

The gain from the sale of shares is. Step 5 - Review Outputs of RSU Tax Calculator.

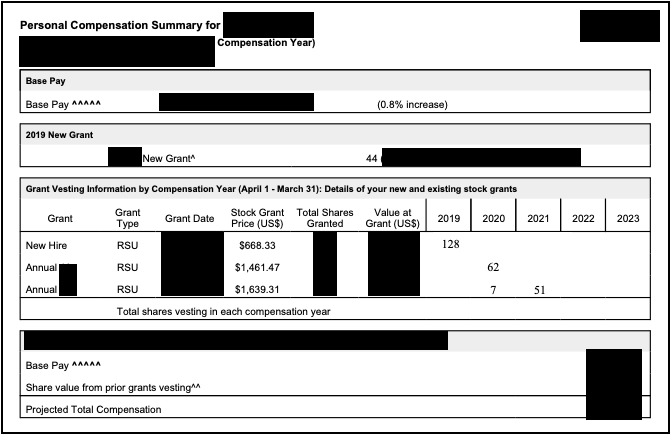

Demystifying Your Amazon Rsus Resilient Asset Management

The standard deduction is increasing to 27700 for married couples filing together and.

. Rsu Tax Calculator Ireland. Everything you need to know about Restricted Stock Units how RSUs are taxed and little-known RSU strategies to lower your tax bill in 2022. Tax is paid on the profit made from purchasing the option this is the difference between the option price and the market price when the option is sold.

RSU Taxes - A tech employees guide to tax on restricted stock units. RSUs Restrict Stock Units are the company stocks given to you usually for free however upon receiving the shares vested you have to pay tax based on the fair market value. Rsu Tax Calculator Ireland.

A Restricted Stock Unit RSU is a grant or promise to an employeedirector to the. Restricted stock and RSUs are taxed differently than other kinds of stock options such as statutory or non-statutory employee stock purchase plans ESPPs. This is calculated as follows.

CGT needs to be paid on the difference between the net proceeds you. Now that you know the basics of how rsus work you can now confidently use the rsu tax calculator below. Paying tax on share options in Ireland.

RSUs are taxed at the ordinary income rate and tax liability is triggered once they vest. Skip to main content. Claires tax on the RSU vest.

Once all the assumptions have been entered the RSU tax calculator will provide three outputs and they are all pretty self. At any rate RSUs are seen as. That the holder may have been resident in Ireland at the time of the grant and during the vesting period.

In Monikas example above the following would. If youre looking for an rsu tax calculator for. RSUs chargeable to Income Tax under Schedule E are within the scope of the.

Value of Shares10000 shares 3 30000. Now that you know the basics of how rsus work you can now confidently use the rsu tax calculator below. Emily made an Exercised Share Profit of 20000.

How Are Restricted Stock Units RSUs Taxed. RSUs are taxed as ordinary income thus the rate that the recipient may pay can range from 10 to 37 depending on the recipients household income. Many employees receive restricted stock units RSUs as a part of their.

If youre looking for an rsu tax calculator for. Restricted Stock Units RSU and Tax - Nathan Trust The gain is calculated against the proceeds and the base value of the RSUs when they vest. The page explains about taxation of Restricted Stock Units RSUs.

Carol Nachbaur April 29 2022. Restricted stock and RSUs are taxed as wages upon delivery and subject to progressive income tax up to approximately 57 percent. Also restricted stock units are subject.

The Sell-To-Cover Method Explained. Some RSU receivers might opt to pay for the tax owed via personal check or would prefer the tax withhold via deduction of their paycheck. This method allows the employer to sell just enough of your vested RSUs to cover the tax burden and distribute the remaining shares to the.

Market value of shares. If you ever decide to sell on your RSUs you will be liable to a different tax Capital Gains Tax CGT. An RSU is a taxable emolument of the employment chargeable to income tax.

Cost of Shares10000 shares 1 10000. 15 hours agoThe IRS has released higher federal tax brackets for 2023 to adjust for inflation. This is different from incentive stock options.

Rsus A Tech Employee S Guide To Restricted Stock Units

How To Manage Us Rsus And Stock Options Awards When Living Overseas Money Matters For Globetrotters

When Do I Owe Taxes On Rsus Equity Ftw

Tax Benefits Of Ireland S Most Popular Employee Share Schemes

Rsus Vs Options What S The Difference How To Switch Carta

2019 Global Mobility Equity Survey Deloitte Us

Employee Stock Options Explained Ireland Rsus Espps Etc Youtube

Why Should Companies Give Rsus Global Shares

Rsu And Taxes Restricted Stock Tax Implications

Are Rsus Taxed Twice Rent The Mortgage

Rsu Tax In Ireland What You Need To Pay File We Have The Expertise

.png?width=2108&name=Add%20a%20subheading%20(9).png)

Rsu Tax In Ireland What You Need To Pay File We Have The Expertise

Rsu Tax How Are Restricted Stock Units Taxed In 2022

How Much Tax Do You Pay On Rsus Restricted Stock Units In Ireland Irish Financial